Tag: investment research

Enhancing Investment Opportunities: How an OCIO Expands Access for RIAs

With new investments and strategies emerging each year, your clients may be interested in evaluating their viability for themselves. However, with client meetings, admin duties, compliance tasks, marketing, and other responsibilities, most RIAs admit they […]

The OCIO’s Role in Supporting RIA Portfolio Protection Strategies

In recent years, market volatility has surged due to geopolitical uncertainties, economic policy shifts, and the rapid spread of information through 24-hour news applications. Volatile markets and uncertain times can make your clients anxious, which […]

How OCIOs Combat Market Volatility With Adaptive Investment Strategies

As an independent RIA/IAR owner of a financial advisory firm, do you often juggle multiple tasks while serving your clients? Do you feel like you’re constantly putting out fires whenever there is significant market volatility? […]

How to Integrate an Outsource CIO into Your Investment Process

The time may be coming when you make a strategic decision to engage the services of an OCIO (Outsource Chief Investment Officer). It can make a lot of sense: You can expand the range of […]

OCIO or TAMP: Which Outsourcing Model Suits Your RIA the Best?

One of the main challenges that independent RIAs or IAR firms are grappling with today is delivering competitive rates of return in a volatile market. Between the rise of different investment strategies, an avalanche of […]

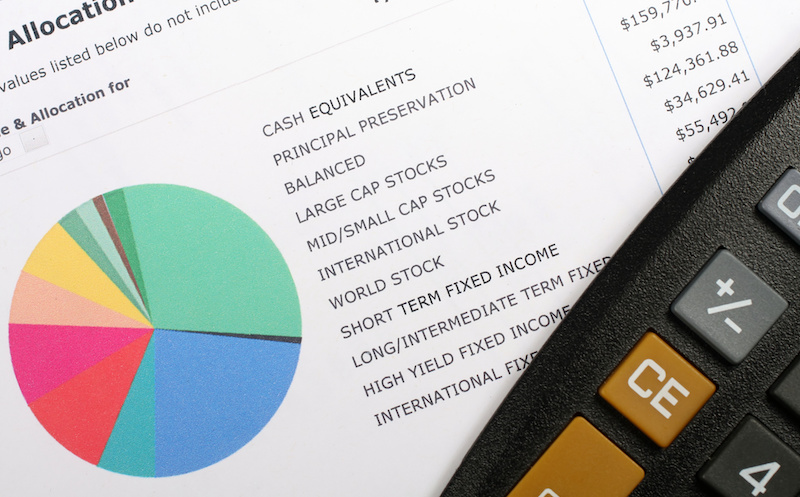

The Tactical Asset Allocation Dilemma: Large Cap or Small Cap Stocks?

One term you’ll often hear about when discussing various investment strategies is “tactical allocation.” It refers to an approach that attempts to capitalize on investment opportunities in rising, flat, and falling markets. The potential for […]

Strategic vs. Tactical Asset Allocation: Key Differences Explained

In the complex world of investment management, understanding the intricate differences between strategic and tactical asset allocation strategies is pivotal for Registered Investment Advisors (RIAs) and firms that provide Outsourced Chief Investment Officer (OCIO) services. […]

Investment Consulting Services: Your Affordable Answer

As an independent advisor, you’re always on the lookout for ways to enhance the value your practice provides to clients while keeping costs under control. With high inflation, occasional market instability, and a possible 2023 […]

Let an Outsourced CIO Prevent Record-keeping Headaches

Are you an independent broker-dealer struggling to keep up with the complications of ever-changing securities regulations? The amount of paperwork, alone, that must be tracked for investment compliance reasons can sometimes become a nightmare. Especially […]

Get Ready for the May Investment Compliance Deadline, Now

The SEC has changed the rules again: In October of 2022, they amended Exchange Act Rule 17a-4, adding new record-keeping requirements. On the upside, broker-dealers no longer have to follow the “write once, read many” […]