In the complex world of investment management, understanding the intricate differences between strategic and tactical asset allocation strategies is pivotal for Registered Investment Advisors (RIAs) and firms that provide Outsourced Chief Investment Officer (OCIO) services. These two investment processes present unique risk and return profiles that can dramatically shape a portfolio’s performance and resilience under various market conditions.

Strategic allocation, the cornerstone of traditional portfolio theory, provides long-term, fixed investment guidelines. Contrastingly, tactical allocation thrives on short-term market inefficiencies, offering flexibility and potential opportunities to outperform strategic benchmarks.

Unraveling these nuances can empower independent RIAs and OCIOs that service them to better align portfolio construction with their client’s financial objectives and risk tolerances.

This article will dissect these strategies further, providing an in-depth analysis of their key differences, applications, and potential impacts on portfolio performance. We will be covering the following:

- What is the Definition and Purpose of Strategic Asset Allocation

- What is the Definition and Purpose of Tactical Asset Allocation

- What are the Key Differences Between Strategic and Tactical Asset Allocation

- What are the Key Similarities Between Strategic and Tactical Asset Allocation

- What are the Drawbacks of Strategic vs. Tactical Asset Allocation

Read our Complimentary eBook: 10 Ways An OCIO Can Help Your RIA Flourish In Down Markets

What is the Definition and Purpose of Strategic Asset Allocation

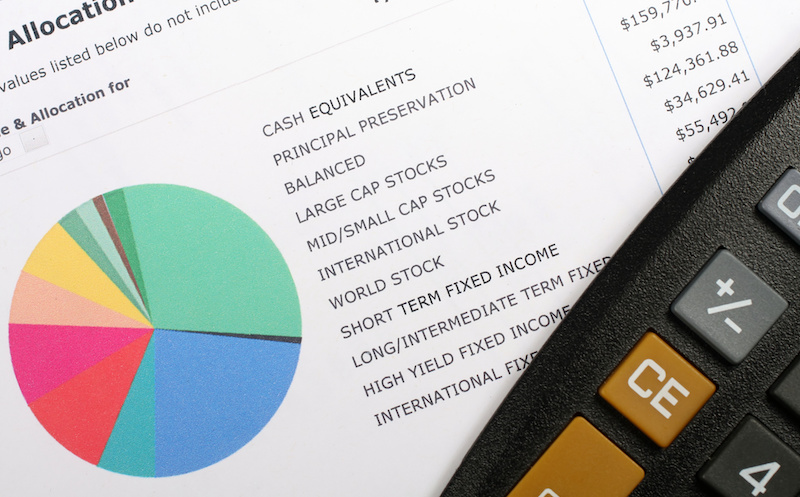

Strategic allocation, also known as strategic asset allocation, is an investment strategy that involves setting an optimal long-term allocation of assets in a portfolio based on the investor’s objectives, risk tolerance, and time horizon. Its goal is to balance risk and return by diversifying investments across different asset classes such as stocks, bonds, real estate, and cash equivalents.

The strategic allocation aims to provide a structured and disciplined approach to investment management. By diversifying across multiple asset classes, an OCIO can reduce the impact of market volatility and potentially enhance investors’ risk-adjusted rates of returns over the long term. It helps investors align their portfolios with their financial goals and provides a framework for making investment decisions.

Investors benefit from strategic allocation in several ways:

- It helps manage risk by spreading investments across asset classes that may perform differently under various market conditions. This diversification can reduce the impact of any individual investment’s poor performance on the overall portfolio.

- It provides a systematic approach to investing, helping investors avoid making impulsive decisions based on short-term market fluctuations.

- Strategic allocation encourages a long-term perspective, helping investors focus on their financial goals and avoid reacting to short-term market noise.

Many independent RIAs and IARs are now outsourcing the strategic allocation process to an OCIO. This can free up your time to focus on other critical aspects of client relationship management and financial planning. Using an OCIO can also offer institutional-level investment opportunities and sophisticated risk management techniques that may be limited to individual advisors or their clients

Why Cornerstone: Upon launching Cornerstone, we quickly identified an urgent requirement among smaller advisory firms seeking assistance to grow their practices. Properly executed outsourced CIO services can significantly enhance operational efficiencies, acting as a tremendous driving force. Therefore, we decided to design our services to be fully plug-and-play, ensuring minimal disruption to your existing operations.

What is the Definition and Purpose of Tactical Asset Allocation?

Tactical asset allocation refers to a dynamic investment strategy that involves actively adjusting the allocation of investment assets based on short-term market conditions and expected market trends. Unlike strategic asset allocation, which focuses on establishing a long-term investment plan and maintaining a fixed asset allocation, tactical allocation aims to exploit market opportunities and manage risks in the shorter term.

Tactical asset allocation aims to enhance portfolio returns by capitalizing on market inefficiencies and taking advantage of changing market conditions. By actively adjusting the asset allocation, investors seek to generate additional returns or reduce risk exposure in response to market signals, economic indicators, or other relevant factors. This strategy requires continuous market trends and economic data monitoring to make informed investment decisions.

Investors benefit from tactical allocation as it allows them to capture short-term investment opportunities and adapt to changing market conditions. Investors can enhance returns and manage risk by taking advantage of market inefficiencies and adjusting the asset mix.

Registered Investment Advisors (RIAs) and other financial advisors should consider using tactical allocation to provide value-added services to their clients. By incorporating tactical allocation into their investment management approach, advisors can demonstrate their ability to adapt to changing market conditions and potentially generate better risk-adjusted returns for their clients.

Tactical allocation can help RIAs differentiate themselves in a competitive market and offer their clients a more dynamic and responsive investment strategy.

Selecting an Outsourced Chief Investment Officer (OCIO) to manage the tactical allocation process can benefit RIAs and financial advisors. An OCIO brings specialized investment research, portfolio management, and market analysis expertise and resources. They have the knowledge and experience to monitor markets actively, identify investment opportunities, and execute tactical asset allocation strategies.

An OCIO can provide access to sophisticated investment tools, technology platforms, and research capabilities, which may need to be more readily available to individual advisors or smaller firms. This partnership can enhance the investment management process, improve client outcomes, and enable advisors to offer a more comprehensive and sophisticated investment solution.

Why Cornerstone: Our approach to portfolio research is highly customized, guaranteeing that your clients receive investment advice that perfectly mirrors your firm’s distinct investment philosophy. We believe in maintaining open lines of communication and actively collaborating with you, prioritizing these elements above all.

What are the Key Differences Between Strategic and Tactical Asset Allocation?

Strategic and tactical asset allocation are two distinct approaches used in portfolio management to optimize investment strategies. While both methods aim to achieve superior risk-adjusted returns, they differ in their time horizon, decision-making process, and level of flexibility.

Strategic asset allocation forms the foundation of a portfolio and focuses on long-term objectives. It involves determining the target allocation across various asset classes based on an investor’s risk tolerance, investment goals, and time horizon. This approach is typically implemented through a strategic asset allocation policy designed to be relatively stable and can remain unchanged for extended periods. Then the portfolio’s asset allocation is periodically rebalanced to maintain the desired long-term strategic targets.

On the other hand, tactical asset allocation is a shorter-term and more dynamic approach. It involves actively adjusting a portfolio’s asset allocation based on market conditions, economic forecasts, and valuation metrics. Tactical asset allocation allows portfolio managers to exploit short-term market inefficiencies, take advantage of potential opportunities, or manage risks. It involves deviating from the strategic asset allocation in response to changing market dynamics. Tactical shifts are typically made using quantitative models, technical analysis, or fundamental research.

The key differentiating factor between the two approaches is the frequency and magnitude of portfolio adjustments. A systematic and disciplined approach guides strategic allocation, while tactical allocation requires more expertise and market timing abilities.

Why Cornerstone: You can rest assured that any suggestions we provide are mindful of tax implications and are harmoniously attuned to your investment strategies and procedures. We can progressively refine these strategies, ensuring that your clients undergo a gradual improvement rather than facing a drastic overhaul via numerous trades.

What are the Key Similarities Between Strategic and Tactical Asset Allocation?

Despite their time horizon and decision-making frequency differences, strategic and tactical asset allocation share key similarities. Both approaches want to optimize risk-adjusted returns by diversifying investments across different asset classes. Strategic and tactical asset allocation seeks to manage risk and potentially enhance returns by spreading investments across various asset classes.

Secondly, both strategies require diligent research and analysis. Strategic asset allocation involves thoroughly analyzing historical data, asset class characteristics, and the investor’s risk preferences. Tactical asset allocation demands monitoring market conditions, economic indicators, and other relevant factors to identify potential opportunities or risks.

Thirdly, both strategic and tactical asset allocation requires disciplined execution. Once the target asset allocation is determined in strategic asset allocation, it is important to adhere to the established allocation over the long term unless there are significant changes in the investor’s circumstances. Similarly, tactical asset allocation decisions should be implemented consistently and promptly to capture the intended market opportunities.

Why Cornerstone: Our research and investment models are tailored according to your unique investment strategy rather than being standard or off-the-shelf.

What are the Drawbacks of Strategic vs. Tactical Asset Allocation?

As an experienced Outsourced Chief Investment Officer (OCIO), I understand the nuances and complexities surrounding strategic and tactical asset allocation. When evaluating these approaches, it is essential to consider their respective pros and cons, especially when advising the clients of independent financial advisors.

Strategic asset allocation has limitations. Its rigidity can be seen as a disadvantage, as it may adapt slowly to changing market conditions or take advantage of short-term opportunities. This lack of flexibility can be a drawback in dynamic market environments, where timely adjustments are necessary to exploit emerging trends or mitigate risks. Moreover, strategic allocation may not consider specific market forecasts or individual security selection, potentially limiting potential returns.

Tactical asset allocation carries inherent risks. The ability to accurately time the market and consistently generate alpha is challenging, even for seasoned investment professionals. Making incorrect or ill-timed tactical shifts can lead to subpar performance and erode clients’ confidence. Additionally, the transaction costs associated with frequent portfolio adjustments can eat into returns, reducing the overall portfolio efficiency.

Why Cornerstone: Our approach to portfolio research is highly personalized, assuring you that our recommendations will adhere closely to your firm’s unique investment philosophy. We prioritize working closely with you, ensuring open and constant communication. Our method differs significantly from typical outsourced CIO services. Our integration into your daily operations is seamless, meaning there is no need for you or your team to modify existing workflows or systems. We effectively utilize your existing tools, which include your CRM, custodial software, client reporting, and portfolio management applications. If your firm is in a growth phase or you’re considering delegating all of the investment research and portfolio management process, we would love to discuss this further.