Most smaller RIAs want to grow their assets under management. Only a small percentage of RIAs are satisfied with their current size.

However, growth can be a real challenge if you do not have an effective strategy for generating new leads and converting them into revenue-producing clients.

Step one is to get in the game. If you are using Inbound Marketing, this means you have to be competitive with other firms when investors use the Internet to find and research financial advisors.

Step two is to make it through the initial investor interviews so that you are one of the finalists.

Step three is convincing investors that you are their best choice for a financial advisor.

This is a complex sales funnel, but an OCIO (Outsourced Chief Investment Officer) can help.

How do OCIO’s create competitive advantage?

We believe OCIOs can create the competitive advantage you need to generate more leads and convert a higher percentage of those leads into clients.

A boutique RIA is an independent contractor who serves on your team by telecommuting. A good one can handle as much or as little of your investment decision-making and risk management as you choose.

However, to utilize them as a competitive edge, we are convinced that you should delegate as much investment management to a reputable OCIO as possible. I’ll explain how this can help in detail later.

For now, let me summarize by saying that it can free you up to advise clients more and worry less. Managing relationships and prospecting can become your top priorities again. Freed up from tasks like research, you could focus on growing your customer base.

The benefits of a good outsourced CIO are numerous, but they boil down to providing the horsepower and expertise to do what you do best with confidence.

Granted, if you had the deep pockets of a mega-firm, you could simply hire a CIO in-house. However, when you add up their salary and benefits plus bonuses, insurance… it gets expensive fast.

You could tap someone on your team to become CIO, but the skills, knowledge, certification, and experience required do not grow on trees. In the long run, you might wind up burning out that employee and still remain behind on retention and growth.

Shouldering the role yourself is an option, too. To be honest though, if you are already wondering if you could make time to close prospects again someday, you can do the math.

Hiring a TAMP or SAM for asset allocation might help, but that can also get expensive fast. We believe you could see more business growth by hiring a quality OCIO, instead.

Have We Got Your Attention?

We Are Eager To Help You Streamline Your RIA.

Grow My Business: How an OCIO Helps You

A good outsourced chief investment officer can provide all the advantages of a CIO under your roof for a fraction of the costs of an on-premises hire. You don’t even have to share your stapler with them.

If you hope to onboard UHNW clients, be aware that absentee advising will not make the cut. As many as 93% prefer that an advisor initiate contact to keep in touch. Some want to be contacted in regard to financial planning, either every quarter (35%) or monthly (32%).

If you cannot make time for them, they will entrust their assets to someone who does. Conversely, if you are freed up to nurture relationships with existing customers, we think you could see both improved growth and retention.

After all, it is the personalized attention and human interaction that can set your financial services apart from a robo-advisor’s, right? This seems to be the popular perception, at least.

A Vanguard survey released in 2022 found that 90% of human advisory clients wouldn’t even want to try a robo-advisor. In fact, as many as 88% of current robo-advisor clients say they may consider jumping to human wealth management at some point.

Meanwhile, periods of market instability are peak season for clients leaving their (human) financial advisory firms in search of a replacement. As a result, this could be an unusually good time for prospecting.

Bottom line, we believe offloading time-consuming investment research to an OCIO could free you up to go after them.

You will never know much your client base could have expanded if you never try, though. Your firm’s credibility might benefit from the boost of having an outsourced CIO on your meet-our-team page, too.

We believe the better kind of OCIO is an accredited CFA® Charterholder. That kind of certification, experience, and knowledge is not run-of-the-mill.

Harness the Horsepower To Compete Bigger

Humor me, if you would: Take an honest look at your website’s team page and imagine what a UHNW lead is going to think.

Now, imagine that you have the horsepower of an experienced Chief Investment Officer who is a CFA Charterholder casually on display. How might their reaction change?

Can you see the difference? We are convinced that your prospective clients will. The contrast isn’t just noticeable—it can redefine who you are to your leads.

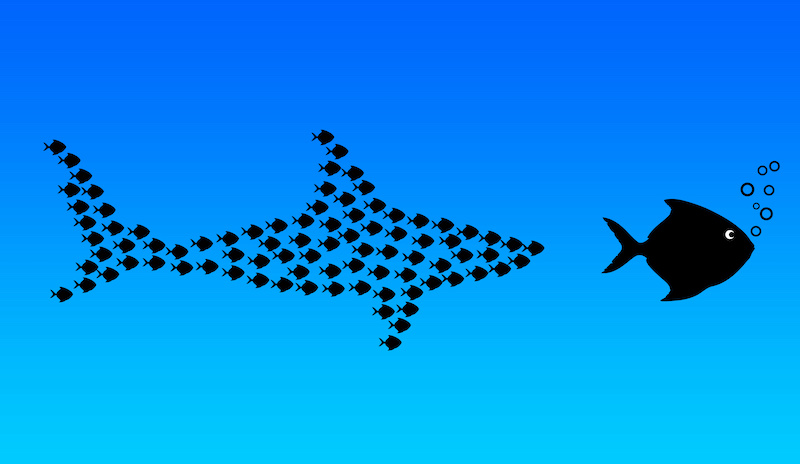

This could be a very good thing if you have ever considered competing with the big names. To be blunt, if you have the ambition to take on larger financial firms, you might need every advantage you can get.

Fortunately, an OCIO-propelled boutique advisory firm may have better odds against mega-firms than you would expect. The big names are widespread, but they have yet to cause the extinction of the small RIA.

Some people prefer a wirehouse or mega-firm for the panache of the brand. However, there are still many potential customers seeking a homegrown, more local feel. They know that this is usually found exclusively at a boutique wealth management firm.

A quality OCIO can support that feel by adding to your confidence through seasoned, expert portfolio management. In addition to impressive certifications, the best ones bring experience anywhere from multiple market cycles to decades.

They may also offer services like custody and banking or transition management. These can help streamline the management of your firm’s financial situation while making things more convenient for your clients.

In case you’d like to know more, we’ve created a free eBook for you that delves further into how a reputable outsourced CIO can help you get ahead. If you want specifics relevant to your firm now, please contact us at your earliest convenience.

Interested In Going Next-Level With Your Firm?

Reach Out And Discover The Possibilities!

Cornerstone Portfolio Research (“Cornerstone”) is an SEC-registered investment adviser. Registration as an investment adviser does not imply a certain level of skill or training. This publication should not be construed by any consumer or prospective client as Cornerstone’s solicitation or attempt to effect transactions in securities or the rendering of personalized investment advice over the Internet.

The statements in this publication are the opinion of Cornerstone regarding Outsourced Chief Investment Officer (“OCIO”) services. These are not personalized recommendations and you should consider your own criteria when choosing an OCIO.

A copy of Cornerstone’s current written disclosure statement as set forth on Form ADV, discussing Cornerstone’s business operations, services, and fees is available from Cornerstone upon written request. You should not assume that any discussion or information contained herein serves as the receipt of, or as a substitute for, personalized investment advice from Cornerstone or the professional advisors of your choosing.