Today’s independent broker-dealers are looking for ways to differentiate themselves from the competition and attract more business. At the same time, the demands of keeping Reg-BI-compliant may never have been as high.

An outsourced Chief Investment Officer (OCIO) can help you do all these things and more. If you’re looking for a way to improve your firm without destroying your budget, please read on.

This article discusses these topics:

- Independent broker-dealers’ challenges are growing

- Reg-BI has reached its terrible twos: Now what?

- Adding a team member without paying benefits

- How an outsourced CIO can help with compliance

Independent Broker-Dealers’ Challenges Are Growing

In the current economic climate, independent broker-dealers are finding themselves with more and more hills to climb. Regulatory and compliance issues are at the top of the list as constant changes to industry regulations require firms to budget for added costs associated with staying compliant.

The ability to stay in business often comes down to meeting stringent requirements set forth by regulatory agencies, such as FINRA and the SEC. On top of this, firms must ensure that all their activities are correctly documented and reported to relevant bodies. That includes timely filing of forms such as 1099s and quarterly statements.

Meanwhile, competition from large financial institutions keeps heating up. Unfortunately, they can often offer advantages that an independent firm may not be able to match. Additionally, they may have better access to both capital and technology, bringing a global reach to bear that’s tough to beat.

These are just some of the hurdles independent broker-dealers must clear to keep in operation today. All is not lost, but it’s probably safe to say that the stakes have rarely, if ever risen this high within the industry.

Reg-BI Has Reached Its Terrible Twos: Now What?

Okay: the deliberately attention-getting header above may be over-the-top. I certainly don’t oppose accountability within the financial industry. Nevertheless, I don’t think you’ll find many advisors ready to swear that the new regulations have brought nothing but good.

Reg-BI has been in full effect for two years now, allowing investors and industry professionals the time to assess this regulatory measure’s impacts. It was intended to ensure that customers are provided with useful information about their investments and it does that. However, some say it’s too restrictive in regard to areas such as commission-based fees.

Keeping honest is always a good thing. At the same time, adding what might be unnecessarily burdensome red tape in order to promote integrity has made the new rule a mixed blessing in the eyes of many. Thankfully, in the future, Reg-BI will likely be augmented or changed to fit financial conditions and customer preferences better by a financial industry regulatory authority.

Today, firms have to be proactive to ensure that they can remain compliant with any necessary adjustments along the way there. Rule changes, combined with economic developments, will need to be carefully monitored to keep operations secure from disruption.

Is Your Firm Ready for Q1 2023 (and Are You Sure)? It’s Possible to Future-Proof It—And We Can Help.

Adding a Team Member Without Paying Benefits

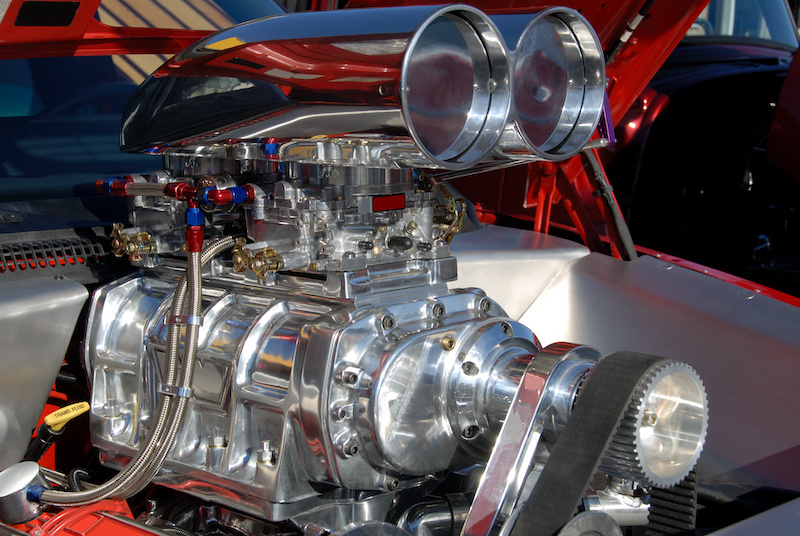

By hiring a good outsourced chief investment officer (OCIO), you can access the same quality of financial insight that is typically found in the top elite firms—without having to pay out the extensive costs of bonuses, salary levels, and benefits. Think of it like dropping a bigger engine into your firm that you don’t have to cover 100% of the upkeep and fueling on.

You could say that the OCIO model might provide the best of both worlds: An experienced one can rev up your reviews, having provided proactive input on possible changes necessary to remain compliant with industry regulations. At the same time, you don’t even have to provide this executive with a parking space.

Don’t get me wrong: The better OCIOs do join your team. In fact, you’ll probably want to list him or her on your Our Team page long-term, for multiple reasons. However, they work with you (and, if you like, your clients) remotely, eliminating the need even to provide a desk.

How an Outsourced CIO Can Help With Compliance

At the risk of hammering the point too much, Reg-BI’s increasingly complex requirements could get more cumbersome before things start to improve over the long haul. The level of compliance they want may be frustrating at times, but it’s not going away anytime soon. If expanding your team doesn’t cost as much as an in-house hire and the same professional can help you keep fully compliant, hiring the OCIO is a no-brainer.

At the risk of hammering the point too much, Reg-BI’s increasingly complex requirements could get more cumbersome before things start to improve over the long haul. The level of compliance they want may be frustrating at times, but it’s not going away anytime soon. If expanding your team doesn’t cost as much as an in-house hire and the same professional can help you keep fully compliant, hiring the OCIO is a no-brainer.

In addition to their specialized industry knowledge and experience, the better ones can manage any associated documentation or compliance issues that may arise. This helps ensure due diligence is conducted on all investments (and any paperwork is carefully maintained). Outsourcing a reliable CIO can provide a myriad of other benefits, as well.

Working with this level of horsepower can mean giving your team the confidence to make prudent investment decisions yielding beneficial outcomes for many years to come. The better OCIOs are well-accredited, holding both degrees and certifications (some of which may impress both prospects and up-and-coming members of your staff).

At the same time, they can be accessible for questions from both staff and clients alike at your discretion. Not every firm can say that they have a CFA® Charterholder on their roster, but independent broker-dealers (and RIAs) that outsource to Cornerstone Portfolio Research enjoy the privilege.

It’s not unheard of for a high-net-worth client to research a potential advisor thoroughly before ever making contact. Imagine what having a Chartered Financial Analyst® on the team could do for you, prestige-wise, when they visit your site! With respect to your current line-up, that could provide quite a boost.

You never know, either: This extended period of market volatility, which is spurring some investors to consider switching advisors, might be the time in which you need it most. It’s always better to inspire extra confidence than wonder if you could have done more toward retention later. Contact us to learn more.